6 Simple Techniques For Pvm Accounting

Wiki Article

The 5-Minute Rule for Pvm Accounting

Table of ContentsThe 30-Second Trick For Pvm AccountingGetting My Pvm Accounting To WorkThe 15-Second Trick For Pvm AccountingWhat Does Pvm Accounting Do?The Greatest Guide To Pvm AccountingWhat Does Pvm Accounting Mean?

Look after and manage the development and authorization of all project-related invoicings to consumers to promote excellent communication and prevent concerns. construction taxes. Guarantee that suitable records and documentation are sent to and are upgraded with the IRS. Guarantee that the accountancy process abides with the regulation. Apply required building bookkeeping criteria and procedures to the recording and reporting of building task.Interact with numerous financing firms (i.e. Title Firm, Escrow Firm) concerning the pay application process and requirements required for settlement. Help with implementing and keeping inner monetary controls and treatments.

The above statements are intended to explain the general nature and degree of job being executed by individuals designated to this classification. They are not to be interpreted as an extensive checklist of obligations, responsibilities, and abilities needed. Workers may be called for to carry out tasks outside of their regular obligations from time to time, as required.

The Buzz on Pvm Accounting

You will aid support the Accel group to guarantee distribution of successful on schedule, on budget, projects. Accel is seeking a Construction Accounting professional for the Chicago Workplace. The Building Accounting professional executes a variety of audit, insurance conformity, and project management. Functions both separately and within details departments to keep monetary documents and make certain that all documents are maintained current.Principal responsibilities consist of, however are not restricted to, handling all accounting functions of the business in a timely and precise fashion and giving reports and schedules to the company's certified public accountant Firm in the preparation of all financial statements. Ensures that all bookkeeping procedures and functions are handled accurately. Responsible for all financial records, payroll, financial and daily operation of the bookkeeping function.

Prepares bi-weekly test equilibrium records. Functions with Task Managers to prepare and post all monthly billings. Procedures and issues all accounts payable and subcontractor payments. Generates month-to-month recaps for Workers Compensation and General Responsibility insurance policy costs. Creates monthly Job Cost to Date records and dealing with PMs to fix up with Project Supervisors' budget plans for each project.

All about Pvm Accounting

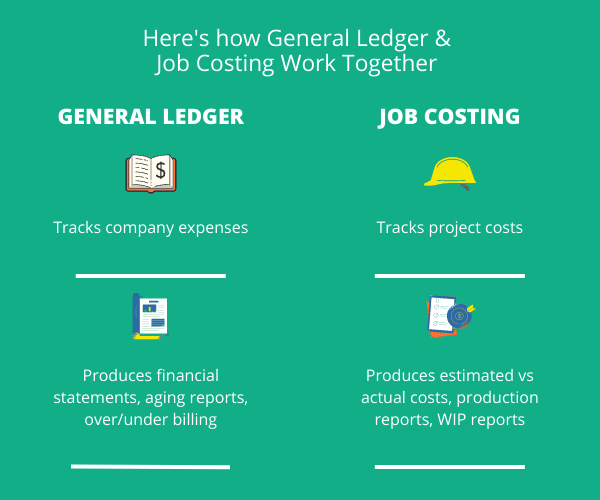

Efficiency in Sage 300 Construction and Real Estate (formerly Sage Timberline Workplace) and Procore building management software application an and also. https://worldcosplay.net/member/1768246. Should additionally excel in various other computer software application systems for the prep work of reports, spreadsheets and various other audit analysis that may be called for by management. construction bookkeeping. Need to possess strong organizational abilities and capacity to focus onThey are the financial custodians that make certain that construction jobs stay on budget plan, comply with tax guidelines, and preserve economic openness. Building and construction accounting professionals are not just number crunchers; they are strategic partners in the construction procedure. Their primary role is to manage the financial aspects of construction jobs, making sure that sources are alloted successfully and economic threats are decreased.

Not known Factual Statements About Pvm Accounting

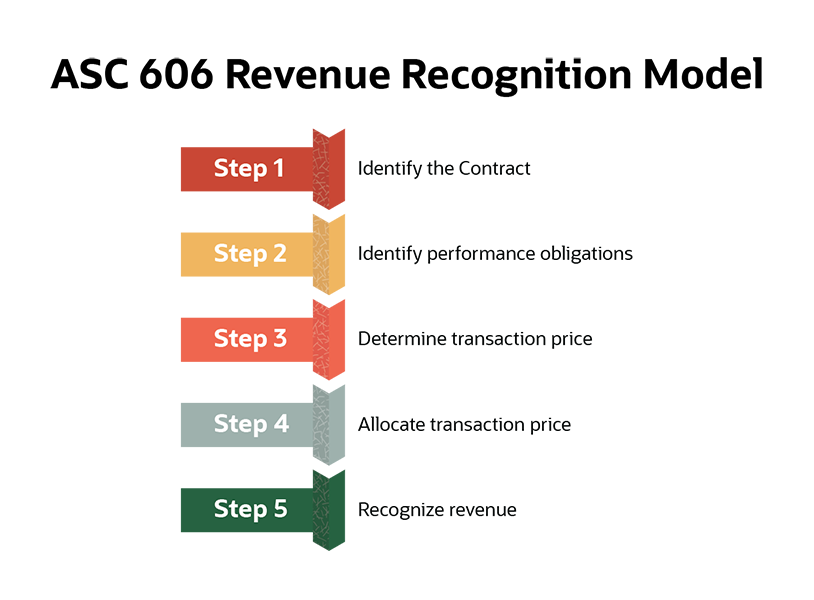

They work carefully with task supervisors to produce and keep track of budgets, track expenditures, and projection monetary requirements. By maintaining a limited grip on task funds, accounting professionals assist prevent overspending and economic problems. Budgeting is a foundation of effective building and construction tasks, and building accountants contribute in this regard. They develop in-depth budgets that incorporate all project expenses, from materials and labor to permits and insurance policy.Navigating the complicated internet of tax guidelines in the building sector can be challenging. Building and construction accountants are fluent in these regulations and make sure that the task abides by all tax obligation requirements. This includes handling pay-roll tax obligations, sales taxes, and any type of various browse around these guys other tax obligation obligations certain to building and construction. To master the function of a building and construction accounting professional, individuals need a strong academic foundation in accounting and money.

Furthermore, qualifications such as Qualified Public Accounting Professional (CPA) or Certified Building And Construction Sector Financial Expert (CCIFP) are extremely related to in the market. Construction tasks commonly include tight target dates, changing laws, and unforeseen costs.

Pvm Accounting Can Be Fun For Anyone

Specialist qualifications like certified public accountant or CCIFP are additionally extremely suggested to demonstrate know-how in building and construction audit. Ans: Building accountants produce and keep track of budgets, recognizing cost-saving chances and guaranteeing that the project remains within spending plan. They likewise track expenses and projection monetary needs to prevent overspending. Ans: Yes, building and construction accounting professionals manage tax obligation compliance for building and construction jobs.

Intro to Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction business need to make challenging selections amongst several monetary alternatives, like bidding process on one project over another, choosing funding for materials or devices, or establishing a job's profit margin. In addition to that, construction is a notoriously unpredictable industry with a high failure price, slow time to payment, and irregular capital.

Typical manufacturerConstruction organization Process-based. Production entails repeated procedures with quickly recognizable expenses. Project-based. Manufacturing needs various processes, products, and equipment with differing costs. Dealt with place. Manufacturing or manufacturing happens in a single (or numerous) controlled areas. Decentralized. Each project happens in a new area with varying site problems and distinct challenges.

The smart Trick of Pvm Accounting That Nobody is Discussing

Durable partnerships with suppliers ease arrangements and boost performance. Irregular. Constant use various specialized professionals and providers impacts effectiveness and capital. No retainage. Repayment shows up completely or with normal payments for the full agreement quantity. Retainage. Some section of payment might be held back up until job completion even when the professional's work is finished.Regular manufacturing and short-term contracts bring about workable cash circulation cycles. Uneven. Retainage, sluggish payments, and high ahead of time expenses result in long, irregular cash money flow cycles - construction accounting. While typical makers have the advantage of regulated atmospheres and enhanced manufacturing processes, building business have to continuously adapt per new job. Even somewhat repeatable jobs call for alterations as a result of website problems and other variables.

Report this wiki page